The kids are counting down the days until Christmas and the the curve of excitement knows only one direction. In contrast are the news we cover in this week’s edition of the Jolly Cellar Master weekly as the narratives we picked weave a tapestry of the current state of the wine world – a complex interplay of health concerns, shifting consumer preferences, and market dynamics. They reflect a sector in flux, responding to global trends, economic pressures, and evolving tastes. As we observe these changes, it becomes evident that the wine industry, much like the beverage it cherishes, is dynamic and ever-evolving. Here we go.

A Glass Half Empty?

Global Health and Wine Economics: A Call for Action from WHO

As the World Health Organization (WHO) scrutinizes the global alcohol taxation policy, the wine industry finds itself at a crossroads of health and economics. The WHO’s recent report strikes a chord of concern, asserting that taxes on alcohol and sugary drinks are dismayingly low worldwide. This move is not just a bureaucratic shuffle; it’s an earnest plea to nations to use fiscal policies as a lever to promote healthier choices among their populations.

Central to this discourse is the intriguing exemption of wine from consumption taxes in at least 22 countries, including Germany with its 0% wine tax rate. This exemption emerges as a critical point of debate, especially considering the WHO’s findings from a 2017 study. The study suggests a staggering potential: a 50% hike in global alcohol prices could prevent 21 million deaths and accrue an additional government revenue of around $17 trillion over 50 years. Lithuania’s experience, with its increased alcohol taxes leading to both higher revenue and a reduction in alcohol-related deaths, stands as a testament to the potential impact of such policies.

Amidst these fiscal maneuvers, Weinwirtschaft reports, a recent scientific congress in Toledo, Spain, threw another curveball into the mix. The congress highlighted a glaring lack of conclusive scientific evidence on the effects of moderate alcohol consumption, particularly concerning alcohol and cancer. This ambiguity, underscored by oncologist Dr. Justus Affelstaedt, adds layers of complexity to the ongoing dialogue about alcohol, health, and taxation.

Shifting Sands in Wine Production and Consumption Trends

On a different note, the wine sector is witnessing a fascinating shift in preferences, as detailed in a comprehensive report by the Statistics Department of the International Organisation of Vine and Wine (OIV). Over the past two decades, there’s been a noticeable tilt towards white and rosé wines, with red wines experiencing a decline. This change isn’t just a whimsical trend; it reflects a deeper transformation in consumer tastes and preferences.

The report offers a panoramic view of the evolution in wine production and consumption from 2000 to 2021, highlighting several key insights. Red wine, once a dominant force, has seen a 25% drop in production since its peak in 2004. European countries, traditionally stalwarts in red wine production, are witnessing declines, partially offset by positive trends in non-European countries like Chile, Argentina, and the USA.

White wine, on the other hand, is enjoying a renaissance, thanks in part to the sparkling wine boom. Countries like Italy, the USA, and South Africa are driving this growth, while traditional producers like France and Spain maintain a stable trend.

Rosé wine, often overlooked, has carved out its niche, growing in both demand and supply. The growth is predominantly driven by countries in the Northern Hemisphere, with France leading the charge.

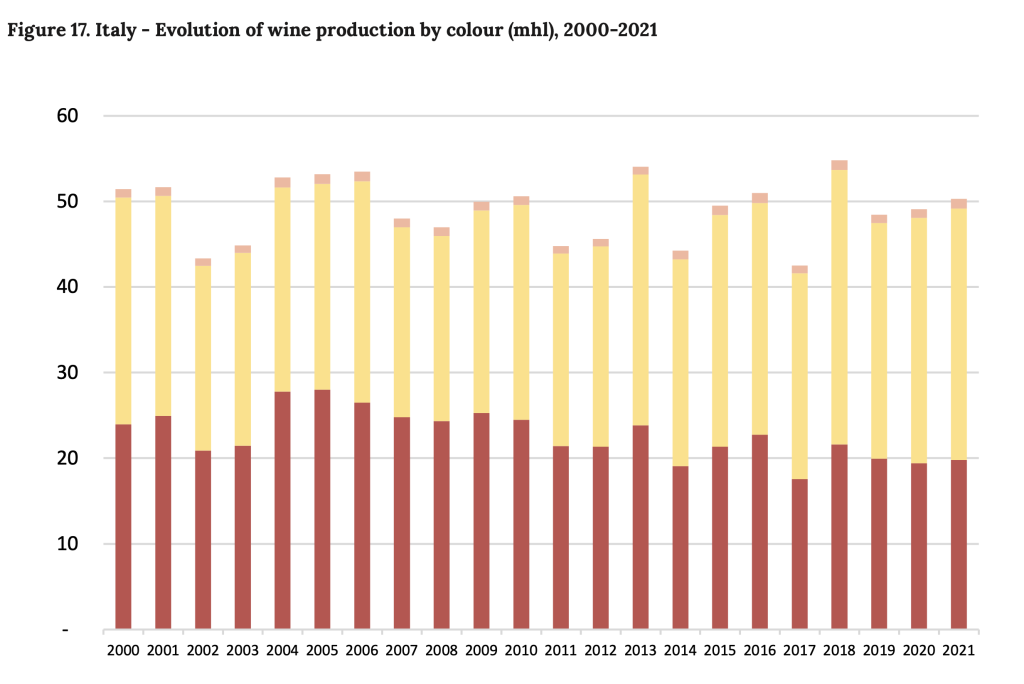

The evolution of Italy’s wine production by colour in million hl from 2000 to 2021 and the country’s consumption in the same period (source: OIV report)

The evolution of Italy’s wine production by colour in million hl from 2000 to 2021 and the country’s consumption in the same period (source: OIV report)

While general trends become apparent, each country is a story of its own and as you may have suspected, I am particularly interested in Italy:

Italy was in 2021 the world’s largest wine producer with 50 million hl, with red accounting for just below 20 million hl, i.e., approximately 40%, and white for 29.4 million hl (the rest, you’ve guessed it, is rosé). Interestingly, the production has shifted over the last two decades when red made up about 50%; the other side of the coin is that white wine accounts now for 60% and the driver of this development appears to be the success story of Prosecco.

On the other hand, Italy is also among the top consumers of wine, ranking second in 2021 with an estimated 24.1 million hl. The distribution, however, is slightly different compared to its production numbers whereas red wine is 9 million hl, white wine 58.9%, and 1 million hl of rosé. That means that while the share of white wine is pretty similar, the share of rosé is twice as big, taking it directly from red wine’s share of total consumption. What is more stunning though is that over the period in question white and rosé wine have seen a steady growth of 10% and 15.4% respectively.

Fine Wine Market: A Landscape of Caution and Retrenchment

In a sobering turn of events, the fine wine market, often seen as a bastion of stability and luxury, faces a downturn, The Drinks Business writes. The Liv-ex 100, a benchmark index for the 100 most sought-after fine wines, fell 1.3% in November, signaling a continuation of a downward trend. This decline, albeit slower than October’s, paints a picture of a market grappling with uncertainty and caution.

The fine wine platform reports all major indices down, with noticeable declines in sectors like Champagne and Bordeaux. This trend underscores a market in buyer’s mode, with a focus on shifting stock rather than exploring new horizons.

Interestingly, amid these challenges, certain regions and wines emerge as beacons of resilience. Wines from Piedmont, Champagne, and Bordeaux are among the top price performers, demonstrating the enduring appeal of established brands and high-quality vintages.

Looking ahead, the outlook for 2024 remains grim. Liv-ex’s annual assessment of market trends points to a cautious and retrenched market, heavily influenced by the macroeconomic climate shaped by the Covid-19 pandemic, geopolitical tensions, and sluggish growth forecasts, particularly in China.

In this landscape, a “flight to quality” is evident, with collectors narrowing their focus to established brands and vintages. Bordeaux, in particular, has regained some of its lost ground, reasserting its position as a safe haven in times of turmoil.

However, the overall picture remains one of caution and retrenchment. With buyers hesitant and sellers reluctant to lower prices, the market is at an impasse. The fine wine market, once a field of exploration and experimentation, now finds itself in a state of cautious navigation, with eyes set on the established and the proven.

—

That’s it for this week but we should be back with one more roundup before Christmas next week. If you have an interesting story to tell though or simply want to chat about wine as a guest on the Podcast, connect on Twitter or drop me a line. And if you want to stay in the loop about things happening at the JollyCellarMaster and the world of wine, make sure you sign up to our newsletter.

—

Disclaimer: As always, I’d like to be completely transparent about affiliations, conflicts of interest, my expressed views and liability: Like anywhere else on this website, the views and opinions expressed are solely those of the original authors and other contributors. The material information contained on this website is for general information purposes only. I endeavour to keep this information correct and up-to-date, I do not accept any liability for any falls in accurate or incomplete information or damages arising from technical issues as well as damages arising from clicking on or relying on third-party links. I am not responsible for outside links and information is contained in this article nor does it contain any referrals or affiliations with any of the producers or companies mentioned. As I said, the opinions my own, no liability, just thought it would be important to make this clear. Thanks!